|

Ward Goldberg is a Registered Investment Advisor with Allied Wealth Partners in Uniondale, N.Y. Ward has over 25 years in the financial services field, including many years in the banking industry prior to joining Allied Wealth Partners. He resides in Huntington, with his wife and children. He can be reached wgoldberg@alliedwealthpartners.com |

|

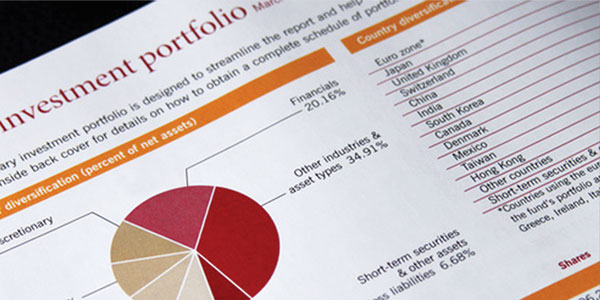

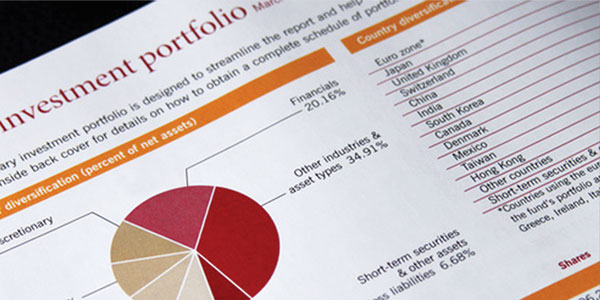

Answer: Generally, you should leave the construction of an investment portfolio to your professional investment advisor, especially if you are investing a significant percentage of your total wealth, or if you're relying solely on the success of your portfolio to meet your future financial goals. However, whether you or your advisor designs your portfolio, consider a few of these well-recognized guidelines. The term "time horizon" refers to how long you plan to keep your money invested. Your time horizon affects your portfolio design because the longer you plan to keep your money invested, the easier it may be for you to ride out dips in the market. You may be able to tolerate more volatile investments, with potentially higher returns (though time alone is no guarantee of higher returns). Your personal risk tolerance also affects your portfolio design. Can you sleep at night knowing that a sudden downward shift in the market could cost you a significant portion of your principal? If not, a portfolio that holds a high percentage of aggressive growth stocks, for example, is not right for you. You should match investments to your personal level of risk tolerance. Should I invest my extra cash or use it to pay off debt? Answer: To answer this question, you must decide how your money can work best for you. Compare the money you might earn on other investments with the money you would pay on your debt. If you would earn less on investments than you would pay on debts, you should pay off debt. Let's assume that you have $1,000 in a savings account that earns an annual rate of return of 4 percent. Meanwhile, your credit card balance of $1,000 incurs annual interest at a rate of 19 percent. Your savings account thus earns $40, while your credit card costs $190. Your annual net loss is 15 percent, or $150, the difference between what you earned on the savings account and what you paid in interest on the credit card balance. It's even worse when you consider the tax effect. The interest on the savings account is taxable, and you have to use after-tax dollars to pay your credit card bill. In the above example, it would be best to use your extra cash to pay down the high-interest debt balance. The same principle would apply if you were to invest your extra cash in a certificate of deposit (CD), mutual fund, or other investment. |

|

20 lucky winners will win $500 each in prizes totaling $10,000.

20 lucky winners will win $500 each in prizes totaling $10,000.